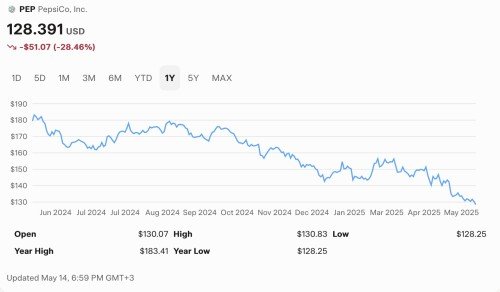

PepsiCo (PEP) stock has reached its lowest levels in over two years, trading at $128.391 as of May 14, 2025, a significant drop from its 52-week high of $183.41. Several factors contribute to this decline, based on recent financial data, market analysis, and broader economic conditions:

- Weak North American Performance and Product Recalls: PepsiCo has faced challenges in its North American operations, particularly in the Quaker Foods North America (QFNA) segment. Reduced consumer demand and product recalls due to contamination issues, such as Salmonella in cereal and snack items, have significantly impacted sales. For instance, the QFNA segment saw a 13% year-over-year drop in organic sales in Q3 2024, contributing to muted overall revenue growth of just 0.6% in that quarter, compared to 6.7% the previous year.

-

Margin Pressure and Tariff Concerns: The company is experiencing margin pressure due to increased supply chain costs and anticipated tariffs. In Q1 2025, adjusted earnings fell 4% year-over-year, despite a 1% organic sales growth, and PepsiCo trimmed its 2025 earnings forecast, expecting flat to slightly negative core constant-currency EPS compared to earlier projections of mid-single-digit growth. Recent tariff-related headwinds, particularly fears of economic disruption from proposed U.S. tariffs under President Donald Trump, have further eroded investor confidence.

-

Underperformance Relative to Peers and Market: PEP stock has lagged behind its competitors and the broader market. Year-to-date, PEP shares have declined 14%, while the beverage industry rose 6.9% and the S&P 500 fell only 4.3%. Competitors like Coca-Cola (KO) gained 15.2% in the same period, highlighting PepsiCo’s relative weakness. This underperformance is partly attributed to PepsiCo’s slower revenue growth and operational challenges compared to peers like Coca-Cola, Monster Beverage, and Keurig Dr Pepper.

-

Cautious Analyst Outlook and Earnings Revisions: Analysts have revised earnings estimates downward, reflecting concerns about tariffs, inflation, and weaker demand. The consensus estimate for 2025 EPS suggests a 2.8% decline, and for 2026, EPS estimates have dropped 4.7% in the past 30 days. The stock’s forward P/E ratio of 16.16X is below the industry average of 18.67X, indicating a lower valuation but also skepticism about near-term growth. Technical indicators also suggest a bearish trend, with some analysts predicting further declines to $120-$130

-

Broader Economic and Consumer Trends: Macroeconomic challenges, including inflation and shifting consumer preferences toward healthier snacks and beverages, are pressuring PepsiCo’s margins and sales volumes. Posts on X and analyst commentary note that PepsiCo’s high payout ratio and stagnant free cash flow growth over the past decade raise concerns about its ability to sustain dividend growth without operational improvements. Additionally, competitive pressures, such as Costco’s switch from Pepsi to Coca-Cola products, may have further dented investor sentiment.

Despite these challenges, some analysts and investors view the current price as a potential buying opportunity, citing PepsiCo’s strong brand portfolio, 4.4% dividend yield, and history as a Dividend King with 53 years of consecutive dividend increases. They argue the sell-off is overdone and that macroeconomic headwinds are temporary, with potential for a rebound as conditions stabilize. However, near-term risks, including ongoing tariff impacts and operational challenges, continue to weigh on the stock.

In summary, PEP’s stock is at two-year lows due to operational struggles in North America, margin pressures from tariffs and inflation, underperformance relative to peers, and a cautious analyst outlook, compounded by broader economic uncertainties. Investors should weigh these risks against PepsiCo’s long-term stability and dividend appeal.