Stock Market in Spain: Operation and Characteristics

In this article, we will explore the characteristics of the Spanish stock market, the types of assets traded, and how to operate within it.

We will also briefly discuss the role of the CNMV as the supervisory body and the advantages and disadvantages of the Spanish stock market.

Keep reading for all the details.

What is the Spanish Stock Market?

The Spanish stock market is a financial market where various types of assets can be traded, such as:

- Stocks: These are securities representing a portion of a company’s capital, granting economic and voting rights to their holders.

- Derivatives: Financial products whose price is linked to the future price of an underlying asset. Typical examples include futures or options, which may be tied to a stock, index, commodity, or other underlying assets.

- ETFs (Exchange-Traded Funds): These are funds traded on the stock exchange that invest in a diverse range of assets (e.g., all companies within a stock index). This allows investors to acquire a proportional share of all the companies included, in a simple and affordable way.

- Fixed Income: Assets such as public or private bonds or debentures represent participation in the debt of the issuing company or entity. They entitle the holder to receive the invested capital plus interest.

When talking about stock market investment, the most common reference is to traditional stock investments (equities), although, as we’ve seen, this is not the only option.

How Does the Spanish Stock Market Work?

Currently, the Spanish stock market operates entirely electronically, like most global financial markets.

Investors, through a broker or intermediary, place buy or sell orders in the system, which are executed as soon as a suitable counterparty is found. Typically, most transactions are completed almost instantly.

Although there are traditionally four stock exchanges in Spain (Madrid, Barcelona, Bilbao, and Valencia), in practice, there is no separation in their operations, as they are interconnected through the SIBE (Spanish Stock Market Interconnection System) and managed collectively by a private company: Bolsas y Mercados Españoles (BME).

The CNMV, the Regulatory Body of the Spanish Stock Market

Although BME is a private company, the supervision of the Spanish stock market falls to a public entity: the National Securities Market Commission (CNMV).

This body is responsible for overseeing and inspecting the Spanish securities markets and the activities of all participants.

Its main functions include:

- Ensuring the transparency of Spanish securities markets and proper price formation.

- Protecting investors.

- Processing the authorization and registration of entities providing financial services.

- Supervising these entities subsequently.

- Providing advice to the Government and the Ministry of Economy.

- Financial translation services for market participants that do not posses the language

Additionally, the CNMV conducts significant educational and informational efforts for individual investors, aiming to improve financial literacy and prevent excessive risks or exposure to financial scams or fraud.

What is the Most Well-Known Index of the Spanish Stock Market?

As you may know, the IBEX-35 is the most important index of the Spanish stock market. It comprises the 35 companies with the highest market capitalization (market capitalization = number of shares × share price).

Its composition may vary depending on the performance of different companies, though changes are not frequent.

Some of the companies in the IBEX-35 include major banks (Santander, BBVA, Sabadell…), Inditex, Telefónica, Enagás, Indra, Repsol, etc.

Individual investors can either directly purchase shares of these companies or buy units in a fund or ETF indexed to the IBEX-35. The latter is undoubtedly the cheapest and simplest way to diversify an investment in the Spanish stock market.

What is BME Growth?

In addition to the main market of the Spanish stock exchange, where established companies are listed, there is also the BME Growth, previously known as the Alternative Stock Market (MAB).

According to its official website, it is “a market aimed at small-cap companies seeking expansion, with tailored regulations designed specifically for them and costs and processes adapted to their characteristics.”

In principle, it is open to companies from any sector.

However, today, there is a greater presence of companies in technology, biotech and health, engineering, telecommunications, renewable energy, and SOCIMIs (Spanish REITs). For foreign actors and participants Spanish legal translation services may be needed.

Why Invest in the Stock Market? Advantages and Disadvantages

Investing in the Spanish stock market presents the same pros and cons as any other stock market investment. The most significant advantages include:

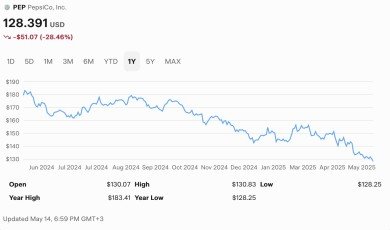

- Return Potential: Although the IBEX-35 has not historically been the index with the highest sustained returns (compared, for example, to the S&P 500), it has experienced periods of significant growth.

- Passive Income: Investing in companies that pay dividends can provide a regular stream of passive income.

- Liquidity: Stock markets are highly liquid, allowing purchases and sales to be executed in seconds (except in exceptional cases).

- Diversification: Whether directly through a broad portfolio of stocks or via funds or ETFs, stock market investment allows diversification across various sectors and companies. However, to add geographic and currency diversification, it’s essential to combine Spanish stock market investments with other markets (both developed and emerging).

From the perspective of listed companies, the stock market is an excellent way to obtain financing for their activities and future growth.

As for the disadvantages, the following stand out:

- Risk of Losses: In addition to potentially unmet return expectations, it is entirely possible to experience partial or total losses of the invested capital.

- Volatility: Price fluctuations can be rapid and significant, especially for certain securities.

- Fees and Commissions: Investing in the Spanish stock market involves various fees and commissions, including broker fees and BME’s stock exchange fees for each transaction.

More details on this topic can be found in the article dedicated to explaining the advantages and disadvantages of stock market investment.

In conclusion, the operation of the Spanish stock market is similar to that of any other global financial market, offering good investment opportunities to build a diversified portfolio.

However, it’s essential to incorporate assets from different geographic areas, countries, and currencies, and to combine equities with other asset types (fixed income, real estate, alternative investments, etc.).